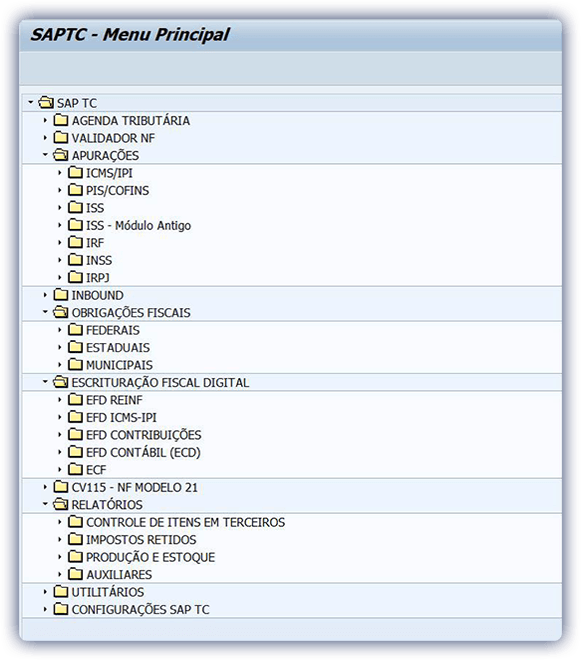

SAP TOTAL COMPLIANCE

The SAP TOTAL COMPLIANCE tax solution fully meets all the needs and demands imposed by the tax authorities on the Brazilian taxpayer.

Developed for SAP ECC and SAP S/4HANA, the results are seen in real time allowing the user to browse the source documents.

State

ICMS / ICMS-ST / IPI

ICMS / IPI calculation

ICMS calculation - AMAZONAS

CIAP

GNRE

Accessory obligations

GIA / State Magnetic Means

GIA-ST

EFD ICMS / IPI

Per / D-Comp (IPI tabs)

SEF II / eDOC

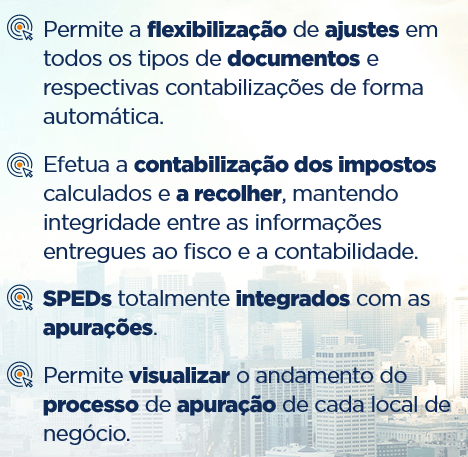

PIS / CONFINS 1. Allow consolidated view of all entries for calculation: invoice, financial invoices or accounting entries. 2. Allow flexible adjustments to all types of documents, without manual intervention and without losing data integrity. 3. Control PIS / COFINS credit balances and their use, with a monitoring and management cockpit. 4. Accounting for taxes calculated and payable. 5. Maintain integrity between the company's accounting information and those delivered to the tax authorities. 6. Allow control of legal proceedings, including those dealing with the exclusion of ICMS from the PIS and COFINS base. 7. Control Retention and Deferral.